Tax season can be daunting, but filing your solar tax credit doesn’t have to be! If you installed solar panels and/or battery backup before January 1, 2026, you might be eligible for the 30% federal solar tax credit (aka Investment Tax Credit, or ITC). But to get that money back, you might need some help.

That’s why we put together a guide for filing your solar tax credit. By following these steps, you will have a solid foundation for getting a big chunk of change back for going solar.

Note: Please speak with a tax professional before filing your solar tax credit Form 5695. Information we provide is for example purposes only and not a detailed guide to your individual filing.

In This Article:

- What You Need Before Filing

- How to Fill Out IRS Form 5695

- Form 5695 Line 14 Worksheet

- Form 5695 FAQs

WHAT YOU NEED BEFORE FILING SOLAR TAX CREDIT

- The receipts from your solar installation

- IRS Form 1040, which is your individual income tax return

- IRS Form 1040, Schedule 3, where you calculate additional credits and payments

- IRS Form 5695, which is the Residential Energy Credit form

- Residential Clean Energy Credit Limit Worksheet – Line 14 to help calculate the tax credit value

- Instructions for these forms (also available from the links above)

HOW TO FILL OUT IRS FORM 5695

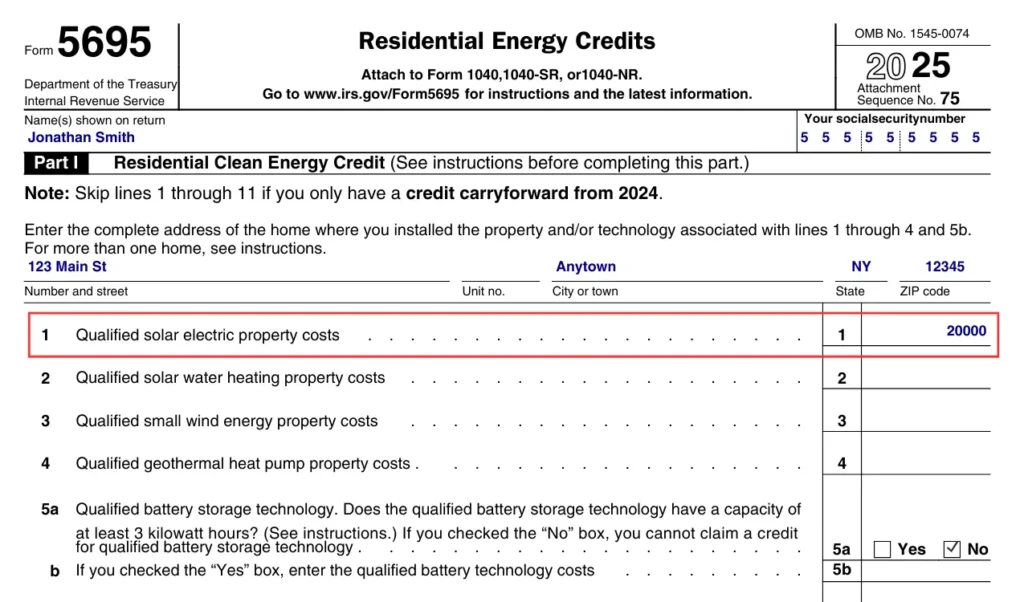

For example sake, let’s use Jonathan Smith as our tax filer. He installed solar panels last year totaling $20,000, and he did not install battery backup technology.

Step 1: Fill out line 1 with the total cost of the solar panel install.

What qualifies as a solar electric property costs? Here’s what the instructions for Form 5695 say:

“Include any labor costs properly allocable to the onsite preparation, assembly, or original installation of the residential energy efficient property and for piping or wiring to interconnect such property to the home.

Qualified solar electric property costs are costs for property that uses solar energy to generate electricity for use in your home located in the United States. No costs relating to a solar panel or other property installed as a roof (or portion thereof) will fail to qualify solely because the property constitutes a structural component of the structure on which it is installed. Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors, and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit. This is in contrast to structural components such as a roof’s decking or rafters that serve only a roofing or structural function and thus do not qualify for the credit. The home does not have to be your main home.”

In short, almost all costs related to the installation of your solar panels and/or battery backup are included. However, be careful not to include extraneous costs, such as reroofing. Reroofing is not a qualifying costs related to a solar panel installation.

Step 2: If you installed a battery backup system/battery storage technology, check mark YES in line 5a and put the total qualifying costs in line 5b.

If you did not install solar water heating equipment, a wind turbine, a geothermal heat pump, or a battery backup system/battery storage technology, move on to line 6a.

What qualifies as a battery storage technology costs? Here’s what the instructions for Form 5695 say:

“Qualified battery storage technology costs are costs for battery storage technology that is installed in connection with your home located in the United States and has a capacity of at least 3 kilowatt hours.“

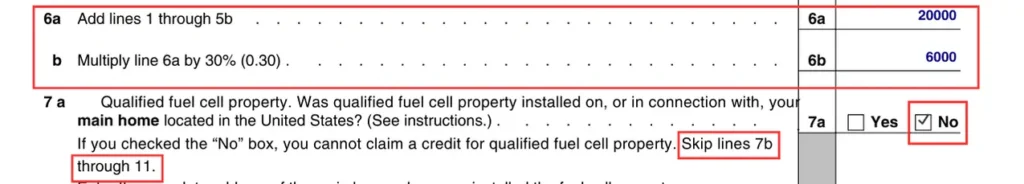

Step 3: In line 6a, put the total from lines 1 through 5. For line 6b, multiply line 6a by 0.3 and write down the result.

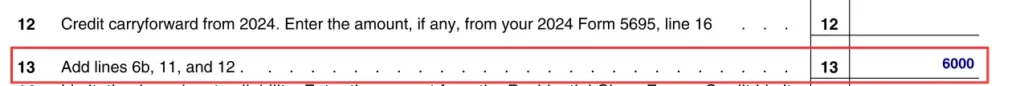

Step 4: Unless you installed fuel cell property, skip to line 12. In line 12, enter any credits you are carrying over from a qualified energy property installation from the previous year. Then fill out line 13 with the total from lines 6b, 11, and 12.

Estimate your total savings, payments, and total energy usage with our FREE solar calculator.

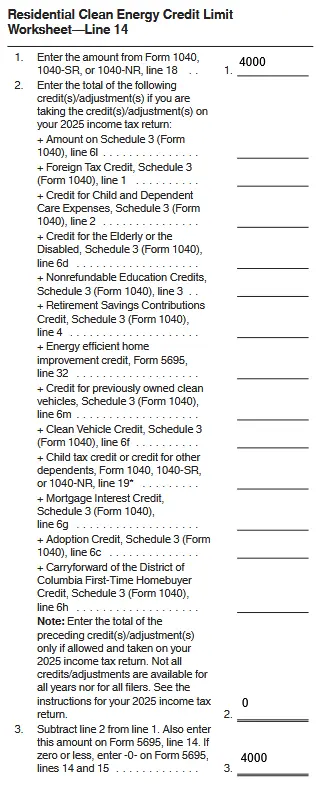

IRS FORM 5695 LINE 14 WORKSHEET – REDUCING CREDIT

The next step in filing your solar tax credit is very important. It’s also a bit challenging: Calculating how much you can actually claim for your solar tax credit.

It’s time to fill out Line 14 of Form 5695, and that’s where the IRS Form 5695 Worksheet comes in handy.

Remember, the solar tax credit (ITC) is not “fully refundable.” Unlike the Child Tax Credit or Health Care Coverage Tax Credit, the solar tax credit can only be used to reduce taxes you already owe. In other words, you will not receive money back from federal government for you solar tax credit. You will only reduce the amount you owe in federal taxes. One bit of good news: You can carry over your tax credit to following tax years.

To calculate the total amount you can claim for you solar tax credit, pull out the IRS Form 5695 Worksheet and go to Line 1. This is where you enter the total tax you owe before credits, as calculated on line 18 of your IRS Form 1040. You can then move onto Line 2, where you will add up all fully refundable credits you are claiming for that tax year. Then, you will subtract line 2 from line 1, giving your final tax liability for line 3. This is the how much you can claim for your solar tax credit this tax year.

In our Jonathan Smith example, he owes $4,000 in taxes this year and is not eligible for other tax credits. So, subtracting $0 from $4,000 results in $4,000, which is entered in line 3. This is the solar tax credit limit, or the maximum amount he can claim for his solar tax credit this year.

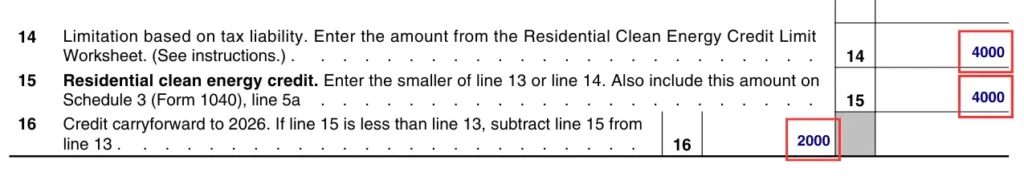

We now jump back to Form 5695 and enter this total into line 14 and 15. From here, we subtract line 15 from line 13. This will give us the difference between total credits and total allowable credits for this tax year (line 16). The difference is the total tax credit carryover for next tax year.

In our Jonathan Smith example, we subtract line 15 ($4,000) from line 13 ($6,000), giving us a total of $2,000 in line 16

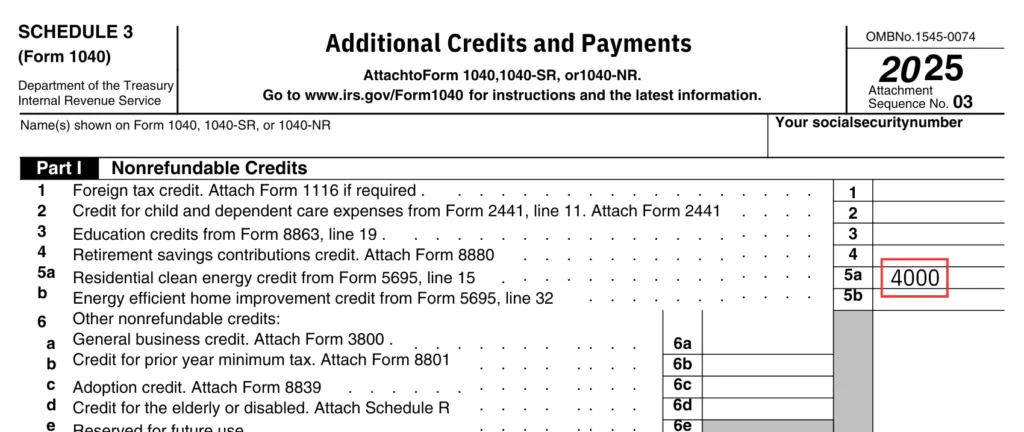

Moving over to IRS Form 1040, you will enter in the total from Form 5695 line 15 into line 5a of the Schedule 3 on Form 1040.

For our Jonathan Smith example, this will be $4,000.

In the end, this means that Jonathan Smith will owe no taxes this year and will have $2,000 worth of tax credit he can carry over to next tax year, as well as subsequent tax years if necessary. All because of the solar tax credit.

FORM 5695 FAQS

Q: I got a rebate from my utility company for my solar panels. Do I calculate the 30% tax credit before or after the reduction from the rebate?

A: We get this question all the time, and here’s the best answer: You calculate the 30% federal tax credit based on the cost to you AFTER any rebates.

For example, if your system cost $20,000 and you received a $5,000 rebate from the utility, your federal tax credit would be 30% of $15,000, which is $4,500. Here’s the tricky part: if your state ALSO gives you a tax credit, you don’t need to worry about that amount to calculate your federal credit.

Both state and federal tax credits are calculated based on the amount you paid, minus rebates or grants.

Q: If I installed a solar panel system a few years ago and now I want to add new panels, can I claim the credit?

A: Yes! You can claim the credit for any new costs associated with the addition. You can’t go back and claim the credit for the previously-installed equipment. Hopefully you already claimed the credit for those costs back then.

Q: If I install solar and claim the tax credit, will I have to repay the credit to the government if I sell my house within a certain number of years?

A: No! If you install a solar panel system on a home you own, you can claim the whole credit and sell at any point after.

The converse is also true; If you are buying a house with solar panels—even if they were just installed by the previous owner—you’re not eligible for any portion of the tax credit. Keep in mind this is only true for home installations. The law is significantly more complex for commercial solar installations.

Q: Can I get a tax credit if I installed solar panels on a rental property I own?

A: If the property is a rental only, you cannot claim the tax credit. However, if you own the property and maintain it as a residence for a certain portion of the year (i.e., you rent it out while you’re away), you can claim the credit for the portion of the year you spend there.

For example, if you installed $20,000 worth of solar panels on a home in Florida that you live in from November 1st to May 1st, and you rent that home during the summer, you are entitled to take 50% of the possible tax credit, or $3,000 (30% of $20,000 is $6,000, and 50% of that is $3,000).

Q: I just received a quote from a solar company. They informed me that I needed a new roof to hold the solar array. Can I get the tax credit based on the cost of both the roof and the solar, as it was an additional cost?

A: Let’s be clear again that we’re not tax experts, but it looks pretty clear that the answer is no. Early in this article, we quoted the instructions for Form 5695. Here it is again:

“No costs relating to a solar panel or other property installed as a roof (or portion thereof) will fail to qualify solely because the property constitutes a structural component of the structure on which it is installed.

Some solar roofing tiles and solar roofing shingles serve the function of both traditional roofing and solar electric collectors, and thus serve functions of both solar electric generation and structural support. These solar roofing tiles and solar roofing shingles can qualify for the credit. This is in contrast to structural components such as a roof’s decking or rafters that serve only a roofing or structural function and thus do not qualify for the credit.”

It’s pretty clear that what they’re saying here is “costs for anything that is necessary to have a regular roof cannot qualify as solar costs.” If only they said it that plainly.

Q: Should I claim the tax credit if I partially paid (i.e., a deposit) in 2025 for an installation that won’t be completed until 2026?

A: No. The instructions for Form 5695 say “Costs are treated as being paid when the original installation of the item is completed,” so you can claim all the costs for your installation no matter when they were paid, but you have to wait to claim them in the year the installation takes place. Keep receipts!

Estimate your total savings, payments, and total energy usage with our FREE solar calculator.